- Future interest rate changes will be determined based on the five-year Constant Maturity Treasury (CMT) yield.

- Origination fees (what SECU charges for processing the mortgage loan) are assessed for 1% of the loan amount, capped at $2,500.

- Manufactured homes can typically serve as collateral but must be the primary residence of the borrower. Terms are limited to a maximum of 20 years.

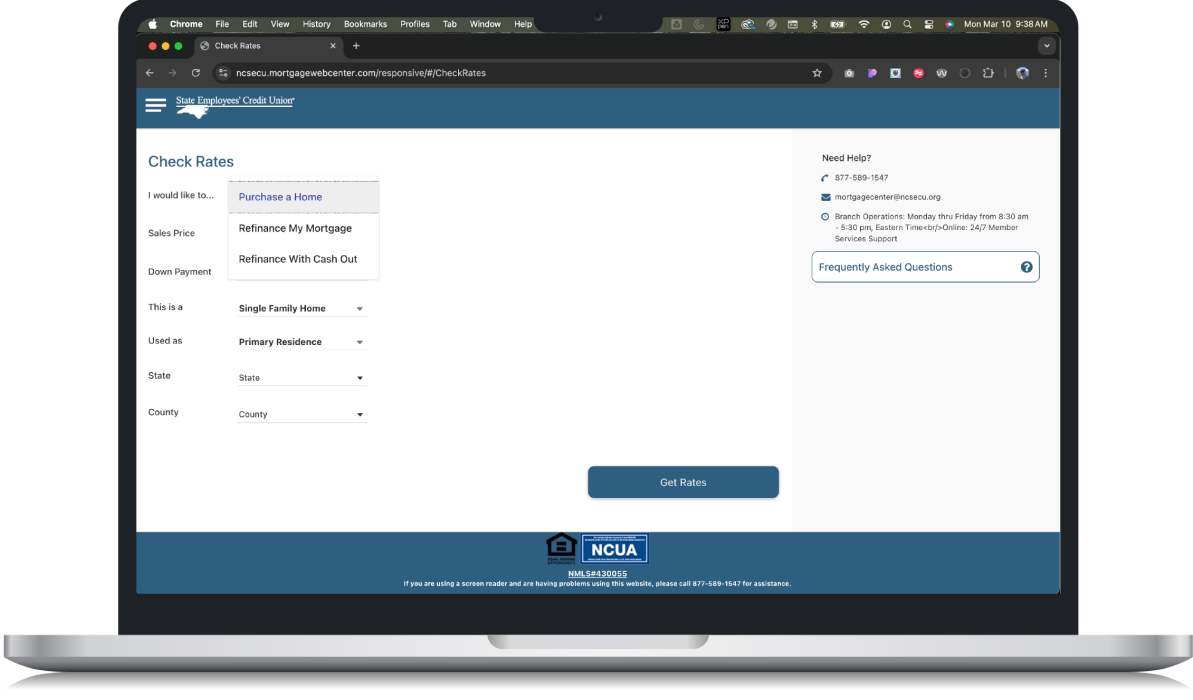

- For purchases, maximum financing and loan-to-value financing tier are determined based on the lesser of the sales price or appraised value of the property securing the loan. Member is responsible for appraisal costs.

- Up to 100% financing available for purchases and no cash-out refinances of single-family primary residences. Up to 90% financing available for cash-out refinances of primary residences. Cash-out is defined as any funds that exceed the balance owed on the first mortgage being paid off, plus closing costs. Greater than 90% financing is relegated to a maximum loan of $500,000. Additional restrictions may apply. Up to 90% financing for purchases and no cash-out refinances of secondary residences; further limited to 75% loan-to-value for cash-out refinances. Up to 85% financing available for the purchase of a one-unit investment property or a no cash-out refinance of a one-unit investment property; further limited to 75% loan-to-value for cash-out refinances. Up to 75% financing available for the purchase of a two- to four-unit investment property or a no cash-out refinance of a two- to four-unit investment property; further limited to 70% loan-to-value for cash-out refinances. Each member may finance up to six properties with SECU, but only one may be financed at greater than 90% LTV.

Be financially prepped for an ARM

Considering a 5-Year ARM? This type of mortgage comes with an interest rate subject to change every five years throughout the life of the loan. Common situations for choosing an ARM include:

-

Understand the home loan amount you can afford.

-

Shop with confidence knowing what range you can afford.

-

Demonstrate your creditworthiness in your offer.

-

Reduce timelines and potentially close on your dream home faster.

Frequently asked questions about Adjustable Rate Mortgages

Adjustable rate mortgages, also known as variable-rate mortgages, have interest rates that may change periodically based on the corresponding financial index. Fixed rate mortgages have an interest rate that remains the same for the life of the loan.

You can’t calculate in advance exactly how much total interest you will pay since the interest rate may change over the life of the loan. However, you can find an estimate by using our mortgage payment calculator.

Closing costs are fees you pay when finalizing a home-buying or refinancing transaction. SECU assesses an origination fee based on your loan amount, which is capped at $2,500. The remainder of the charges, such as title insurance, appraisal fees, attorney fees, homeowners insurance, and property taxes, are paid to third parties. The loan estimate provided at the time of application estimates what closing costs you can expect.