ABA Routing Transit Number

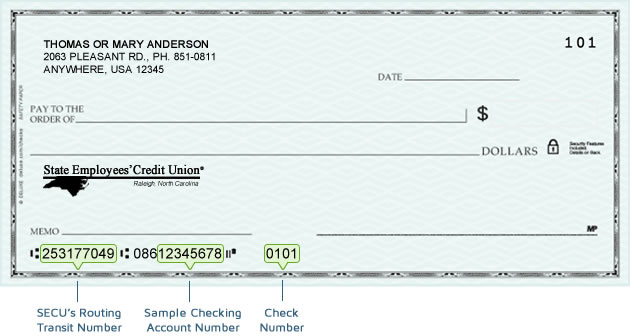

An ABA routing transit number is a 9-digit identification number assigned to financial institutions in the United States. Routing numbers are sometimes referred to as ABA numbers or routing transit numbers (RTN) and can be used to make electronic deposits and withdrawals to and from your accounts through Automated Clearing House (ACH) or wire transfer.This sample check image shows where you can find the Credit Union’s routing number at the bottom of your check, directly beside your account number.

SECU’s Routing Number

253177049

Sample Checking Account Number

12345678

Checking account numbers, as they appear on SECU physical checks, include a prefix of "086," which is not necessary to process electronic transactions and is only used when processing physical checks.

Electronic Deposits and Withdrawals – ACH Debits and Credits

You can authorize ACH debits and credits to and from your Credit Union account to do things like receive your direct deposit or pay utility bills. Funds can be debited from your Checking account; however, debits are not allowed on Share, Money Market Share or other types of accounts.The table below identifies important information needed for sending and receiving ACH debits and credits to and from your Credit Union accounts.

ACH

Deposits/Credits Allowed?

Deposits/Credits Allowed?

ACH

Withdrawals/Debits Allowed?

Withdrawals/Debits Allowed?

Account Number

Format

Format

Checking

Yes

Yes

Can be up to 8 digits; 086 prefix and leading zeroes not required

CashPoints® Global (CPG)

Yes

No

Must be 8 digits; leading zeroes not required

Share

Yes

No

Can be up to 8 digits; leading zeroes not required

Money Market Share

Yes

No

Must be 7 digits; leading zeroes not required

Money Market Share accounts are considered a checking or demand deposit (DDA) account type when completing a Direct Deposit form.

Money Market Share accounts are considered a checking or demand deposit (DDA) account type when completing a Direct Deposit form.